Buffet’s Big Tips: How to Get Rich (Without Eating Too Much)

With a net worth of over $100 billion, Buffet is widely considered to be one of the greatest investors of all time. Lucky for you, he’s not shy about sharing his wisdom. In this article, we’ll dive into some of the biggest tips from Warren Buffet that can help you become a better investor.

One of the most important things that Buffet emphasizes is the importance of patience. He once said, “The stock market is a device for transferring money from the impatient to the patient.” In other words, if you want to be successful in investing, you need to be willing to hold onto your investments for the long haul. Don’t get caught up in the day-to-day fluctuations of the market. Instead, focus on the long-term potential of the companies you’re investing in.

Another key lesson from Buffet is the importance of doing your own research. He famously said, “Never invest in a business you cannot understand.” Before you invest in a company, make sure you understand its business model, financials, and competitive landscape. Don’t rely solely on the opinions of others, including so-called “experts” on TV or social media. Ultimately, it’s your money on the line, so it’s up to you to make informed decisions.

The Oracle of Omaha’s Wisdom

When it comes to investing, Warren Buffet is a name that needs no introduction. The Oracle of Omaha has been sharing his wisdom with investors for decades, and his advice has helped many people achieve financial success. Here are a few of his biggest tips that you should keep in mind.

Never Lose Money: Rule No. 1

One of Warren Buffet’s most famous quotes is, “Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1.” This may seem like a simple concept, but it’s actually quite profound. Buffet believes that the key to successful investing is to focus on preserving your capital. If you can avoid losing money, you’ll be in a much better position to grow your wealth over time.

The Price is What You Pay, Value is What You Get

Another important lesson from Warren Buffet is to focus on the value of an investment, rather than its price. He once said, “Price is what you pay. Value is what you get.” This means that you should look for investments that are undervalued and have the potential to provide a good return on your investment. Don’t just buy a stock because it’s cheap; make sure that it has the potential to grow in value over time.

Buffet’s advice is particularly relevant in today’s market, where many investors are focused on short-term gains and quick profits. If you want to be a successful investor, you need to be patient and focus on the long-term value of your investments.

In conclusion, Warren Buffet’s advice is invaluable for anyone who wants to achieve financial success through investing. By following his tips and focusing on preserving your capital and investing in undervalued assets, you can build a strong portfolio that will provide you with long-term gains. So, take a page out of the Oracle of Omaha’s book and start investing wisely today!

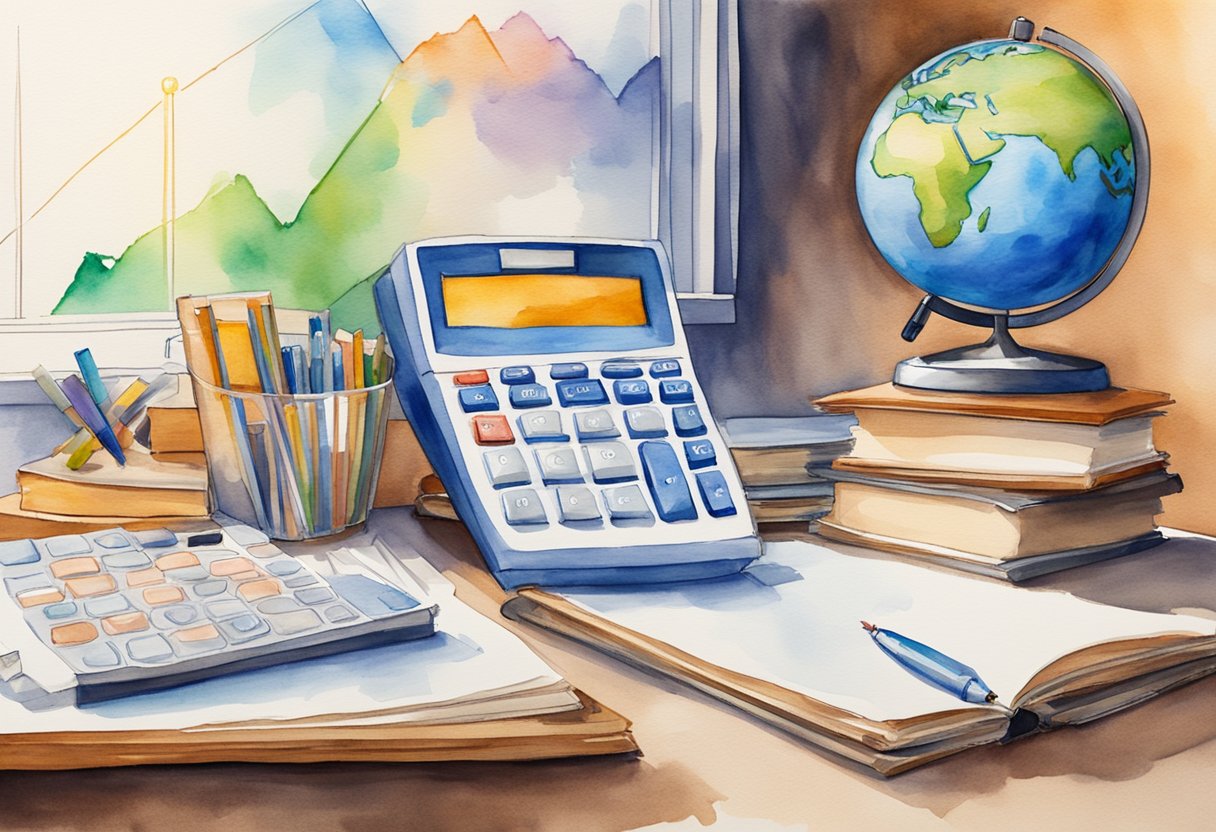

Building Your Buffet-esque Portfolio

So, you want to build a portfolio that would make Warren Buffet proud? Well, you’re in luck because he has some tips for you.

Embrace the Index

First things first, you need to embrace the index fund. As Buffet himself said, “A low-cost index fund is the most sensible equity investment for the great majority of investors.” So, stop trying to beat the market and just join it.

Instead of trying to pick individual stocks, invest in an S&P 500 index fund. This way, you’ll be investing in the 500 largest companies in the US, which is a pretty good slice of the market. Plus, by investing in an index fund, you’ll be minimizing your fees and maximizing your returns.

Diversification: Not Just for Breakfast

Next up, you need to diversify your investments. As Buffet said, “Diversification is a protection against ignorance. It makes very little sense for those who know what they’re doing.”

So, unless you’re a financial genius, you need to diversify. Invest in a mix of stocks, bonds, and cash. This way, if one sector of the market takes a hit, you won’t lose everything.

But don’t just diversify within your own country. As Buffet said, “If you don’t have exposure to non-U.S. stocks, you are missing diversification benefits.” So, consider investing in international stocks as well.

In summary, building a Buffet-esque portfolio means embracing the index fund and diversifying your investments. By doing so, you’ll be minimizing your fees, maximizing your returns, and protecting yourself against market fluctuations. As Buffet himself said, “The stock market is a device for transferring money from the impatient to the patient.” So, be patient, be diversified, and let the market work for you.

Financial Habits of Highly Effective Investors

As Warren Buffet once said, “Chains of habit are too light to be felt until they are too heavy to be broken.” In other words, the habits you form today can have a significant impact on your financial future. Here are some financial habits of highly effective investors that you should adopt:

Frugality is the New Sexy

Contrary to popular belief, being frugal doesn’t mean you have to be cheap or penny-pinching. It’s about being mindful of your spending and making smart choices with your money. As Warren Buffet famously said, “Price is what you pay. Value is what you get.” So, don’t be afraid to spend money on things that bring you value, but always look for ways to save on things that don’t.

One way to practice frugality is to avoid lifestyle inflation. Just because you earn more money doesn’t mean you have to spend more. Instead, focus on building your wealth and investing in assets that will appreciate over time.

Cash: King or Cushion?

When it comes to cash, there are two schools of thought. Some investors believe that cash is king and always keep a large cash reserve on hand. Others believe that cash is a cushion and prefer to invest their money in assets that will generate a higher return.

Warren Buffet falls into the latter category. He once said, “Cash combined with courage in a time of crisis is priceless.” In other words, it’s important to have a cushion of cash on hand in case of an emergency, but you shouldn’t let it sit idle for too long. Instead, invest your cash in assets that will generate a return and help you build wealth over time.

Healthy Money Habits

Finally, one of the most important financial habits of highly effective investors is to develop healthy money habits. This includes things like budgeting, saving, and investing regularly. As Warren Buffet once said, “Do not save what is left after spending, but spend what is left after saving.”

To develop healthy money habits, start by tracking your expenses and creating a budget. Set aside a portion of your income for savings and investments, and make it a priority to stick to your budget. Over time, these habits will become second nature and help you build a strong financial foundation.

In conclusion, adopting these financial habits of highly effective investors can help you build wealth and achieve financial freedom. Remember, as Warren Buffet once said, “The chains of habit are too light to be felt until they are too heavy to be broken.” So, start forming good financial habits today and watch your wealth grow over time.

Playing the Long Game

When it comes to investing, Warren Buffet is known for taking the long-term view. He once said, “Our favorite holding period is forever.” This means that he invests in companies that he believes will do well over the long term, and he holds onto those investments for as long as possible.

Retirement: It’s Sooner Than You Think

One of the reasons that Buffet takes the long-term view is because he knows that retirement is sooner than you think. He once said, “Someone’s sitting in the shade today because someone planted a tree a long time ago.” This means that you need to start planning for your retirement now, even if it seems far away.

One way to do this is to start saving for retirement as early as possible. Buffet recommends investing in a retirement account, such as a 401(k) or an IRA. He once said, “If you don’t find a way to make money while you sleep, you will work until you die.” By investing in a retirement account, you can make your money work for you even when you’re not working.

Compound Interest: Your BFF

Another reason that Buffet takes the long-term view is because he understands the power of compound interest. He once said, “My wealth has come from a combination of living in America, some lucky genes, and compound interest.” This means that if you invest your money wisely and let it compound over time, you can build significant wealth.

One way to take advantage of compound interest is to start investing as early as possible. The earlier you start, the more time your investments have to compound. Buffet recommends investing in low-cost index funds, which allow you to diversify your investments and minimize risk.

In conclusion, if you want to be a successful investor like Warren Buffet, you need to take the long-term view. Start planning for your retirement now, and take advantage of the power of compound interest by investing early and investing wisely. As Buffet once said, “The stock market is a device for transferring money from the impatient to the patient.” Be patient, and you’ll be rewarded in the long run.

Buffett’s Business and Life Philosophies

Invest in Yourself: The Best Stock

According to Warren Buffet, the best investment you can make is in yourself. This means constantly learning and improving your skills and knowledge. As Buffet once said, “The more you learn, the more you earn.” So, don’t be afraid to invest in education, whether it’s through formal schooling or self-education.

Buffet also emphasizes the importance of having a strong work ethic. He believes that hard work and dedication are key to success in both business and life. As he puts it, “You can’t make a good deal with a bad person, and you can’t make a bad deal with a good person.”

Give Back: The Buffett Way

Giving back to others is a cornerstone of Warren Buffet’s philosophy. He believes that those who have been successful have a responsibility to give back to society. Buffet has pledged to donate the majority of his wealth to charitable causes, and he encourages others to do the same.

As Buffet once said, “If you’re in the luckiest 1% of humanity, you owe it to the rest of humanity to think about the other 99%.” He also advises to give back in a way that aligns with your values and passions, whether it’s through philanthropy or volunteering.

In conclusion, Warren Buffet’s business and life philosophies emphasize the importance of investing in yourself, working hard, and giving back to others. By following these principles, you can not only achieve success in business, but also make a positive impact on the world around you. As Buffet himself says, “Someone is sitting in the shade today because someone planted a tree a long time ago.”

Avoiding Pitfalls

Debt: The Dream Killer

You may have heard the phrase “live within your means.” This is a concept that Warren Buffet strongly believes in. He advises against borrowing money for things that you cannot afford. According to him, debt can be a dream killer. It can prevent you from achieving your goals and living the life you want.

In his own words, “I’ve seen more people fail because of liquor and leverage – leverage being borrowed money. You really don’t need leverage in this world much. If you’re smart, you’re going to make a lot of money without borrowing.”

Credit Cards: Handle with Humor

Credit cards can be a useful tool, but they can also be dangerous if not used responsibly. Warren Buffet suggests that you be cautious when using credit cards and handle them with humor. In other words, don’t take them too seriously.

He once said, “I’ve never borrowed a significant amount of money in my life. Never. I’ve never borrowed money for a business deal. I’ve never borrowed money for a stock. Anytime I borrowed money, it was probably a mistake.”

If you do use credit cards, make sure to pay off the balance in full each month to avoid accumulating debt. And remember, credit cards are not a substitute for income. Don’t rely on them to make ends meet.

By being cautious with debt and credit cards, you can avoid financial pitfalls and achieve your financial goals.

The Psychology of Money

Fear & Greed: The Market’s Mood Swings

When it comes to investing, emotions can often get in the way of rational decision-making. As Warren Buffet once said, “Be fearful when others are greedy and greedy when others are fearful.” This means that when the market is booming and everyone is buying, it’s time to be cautious and consider selling. On the other hand, when the market is down and everyone is panicking, it’s time to be bold and consider buying.

It’s important to remember that fear and greed are the two main emotions that drive the market. If you let these emotions control your investment decisions, you’re likely to make poor choices. Instead, try to remain calm and level-headed, and base your decisions on solid research and analysis.

Mindset Matters: Think Like Warren

One of the keys to Warren Buffet’s success is his mindset. He approaches investing with a long-term perspective, and focuses on buying quality companies at a fair price. As he famously said, “Price is what you pay. Value is what you get.”

To adopt a similar mindset, start by focusing on the fundamentals of a company rather than short-term market fluctuations. Look for companies with strong financials, a competitive advantage, and a solid track record. Don’t be swayed by hype or fads, and avoid making impulsive decisions.

Another important aspect of Warren Buffet’s mindset is his willingness to learn and adapt. He’s always seeking out new information and ideas, and isn’t afraid to change his approach when necessary. As he once said, “The most important investment you can make is in yourself.”

Incorporating these principles into your own investing strategy can help you achieve long-term success. Remember to stay focused on the fundamentals, remain calm in the face of market volatility, and always be willing to learn and adapt.

Beyond the Portfolio

When it comes to investing, Warren Buffet is a household name. His investment strategies and insights have proven to be successful time and time again. However, there’s more to Buffet’s success than just his portfolio. Here are a few tips from the Oracle of Omaha on how to succeed beyond the numbers.

Networking: Friends with Financial Benefits

According to Buffet, “It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.” This advice applies to more than just personal relationships. When it comes to investing, networking can be invaluable. By surrounding yourself with successful investors, you can learn from their experiences and gain valuable insights.

Buffet himself has plenty of successful friends in the financial world. Berkshire Hathaway, the company he chairs, has a reputation for investing in other successful companies. By building relationships with others in the industry, you can gain access to valuable advice and opportunities.

Advisors & Media: Filter the Noise

While it’s important to stay informed about the latest news and trends in the market, it’s equally important to filter out the noise. According to Buffet, “The stock market is a device for transferring money from the impatient to the patient.” In other words, don’t get caught up in the hype.

One way to filter out the noise is to find a trusted advisor. Buffet himself has several trusted advisors who help him make investment decisions. By finding an advisor who shares your investment philosophy and has a proven track record, you can gain valuable guidance and avoid making costly mistakes.

Another way to filter out the noise is to be selective about the media you consume. Buffet once said, “I don’t read other people’s opinions. I want to get the facts, and then think.” By doing your own research and thinking critically about the information you receive, you can make informed decisions and avoid being swayed by hype or fear.

In conclusion, while Buffet’s investment strategies are certainly worth emulating, his success goes beyond his portfolio. By networking with successful investors and filtering out the noise, you can set yourself up for success in the world of investing.